As the year comes to a close, we take a look at the World Sugar futures situation, with the chart focusing on the March-20 spot contract. The #11 market is again in the range of the 52 week high, and indicators are pointing towards additional upside in 1Q20.

The run since September caught many in the market by surprise, but there were signs pointing towards this constructive pattern around mid year. In July, we wrote about the current state of the supply side concerns, with respect to sugar, and stressed several of the supporting factors which did materialize as the campaign progressed. The primary factors that we are focusing on are listed below:

- First, in July we discussed the potential implications of the widespread delayed onset of the Indian Monsoon. Even though both of India’s sugarcane belts received impressive rainfall totals later in the season, early crop and post winter growth phases, which tend to serve to set maximum yield potential, were inhibited by a lack of early moisture. Further, when the rains did start to pick up in the middle of the Monsoon season through the end of the seasonal cycle, flooding contributed to additional crop losses, so overall supply fell well short of estimates.

- Satellite measurements of the Evaporative Stress Index (ESI) were highlighting early potential crop stress in major growing regions in India, Brazil, Australia and Thailand. While many analysts spend a significant amount of time and resources on trying to build a perfect yield model, other physical and biophysical indicators can point to early season precursors which can be tied to production enhancement or curtailment.

- The erratic Monsoon was not only a sugarcane issue. Indian output for Cotton, Coffee, Dairy and Soybeans, among other commodities, was also impacted by weather in 2019.

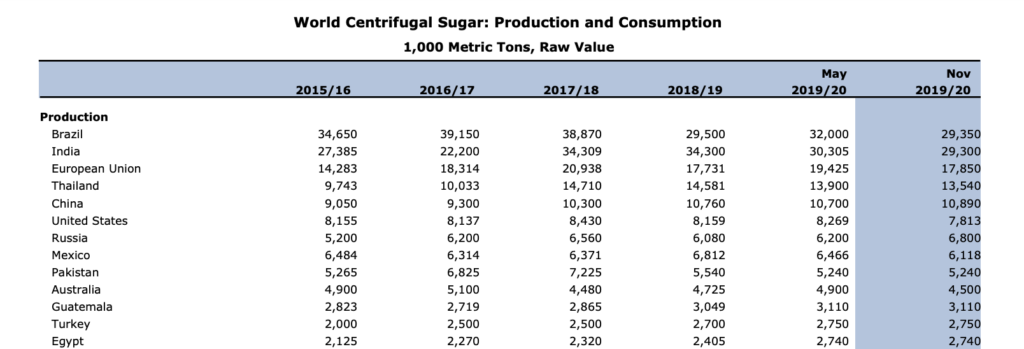

- The global balance sheet for physical sugar estimates are showing a marked decrease in projected output. When the USDA Foreign Agriculture Service issued their 2019/20 production estimates in May, the agency expected a 180.7 mmt crop; when the November estimate was released, the number was decreased by 6.6 mmt to 174.1 mmt. The biggest decrease came from India; while Brazil output is essentially expected to be flat year-over-year, early expectations were much higher, so this downward revision provided additional support to the #11 contract.

- Ethanol is also coming back into favor in Brazil – a factor that we pay close attention to. Part of Brazil’s output reduction was crop related, but it was also tied to a strong shift of cane production being diverted away from sugar in favor of ethanol, supported by higher crude oil prices.

- Finally, when we look at macro drivers, Brazil’s real remains weak. As Brazilian exporters are paid in stronger US dollars, there is an incentive to stimulate exports putting more physical supply on the world market. With global consumption trending higher, there still may be some additional upside to this market though the March/May contract expirations.

Atlas Research Innovations along with our network partners will continue to monitor how the global agriculture and energy complex progresses in 2020. We will share our observations regarding potential risks and opportunities as a function of activity in global natural resource based markets. Our discussions will not include yield model projections; rather, they will focus on the network effects associated with global supply chains, and will explore the range of possibilities that may be expected as a function of the interplay of evolving physical and financial market factors. This methodology, in our view, is the appropriate lens through which to view risk and opportunity in global natural resource and commodity markets. Please reach out to Atlas Research Innovations if you are interested in discussing our approach.